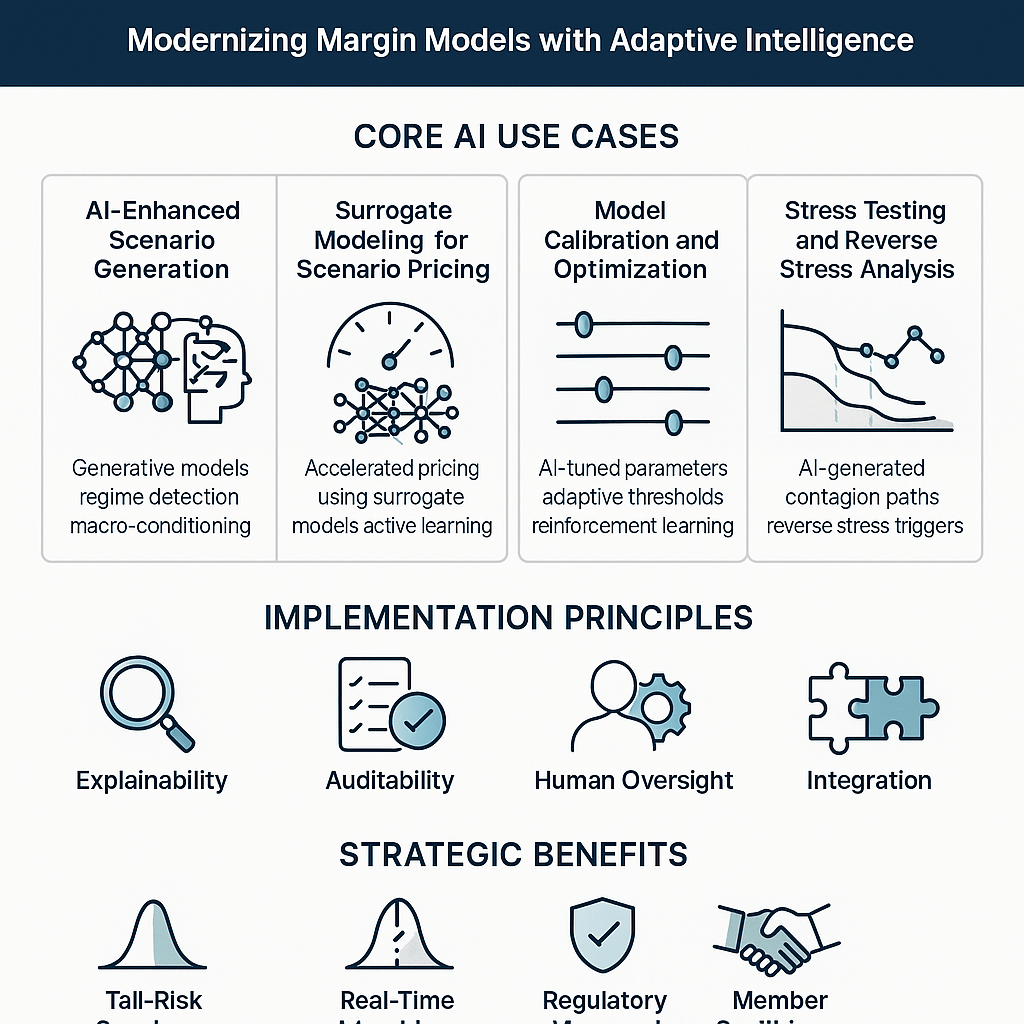

As financial markets evolve in complexity and speed, central counterparties (CCPs) must continuously enhance their risk management frameworks. While traditional margin models have served well, they are increasingly challenged by the need for real-time responsiveness, tail-risk sensitivity, and regulatory transparency. Artificial Intelligence (AI) offers a powerful set of tools to meet these demands.

Below are the most relevant and implementable AI use cases for enhancing CCP margining frameworks, particularly those based on scenario pricing and sensitivity aggregation.

1. AI-Enhanced Scenario Generation

Objective:

Move beyond static historical return windows to generate adaptive, forward-looking stress scenarios that reflect current and emerging market conditions.

Methodology:

- Apply unsupervised learning (e.g., clustering, PCA) to identify historical market regimes and structural breaks.

- Use generative models (e.g., Variational Autoencoders, GANs) trained on historical and synthetic data to simulate plausible but extreme market conditions.

- Integrate macro-financial indicators, volatility surfaces, and sentiment data to condition scenario generation on real-time market context.

Implementation:

- Embed AI-generated scenarios into the existing scenario library.

- Use regime classification to dynamically select or weight scenarios for margin calculation.

- Validate AI-generated scenarios through backtesting and expert review.

Benefits:

- Captures tail risks not present in historical datasets.

- Adapts to changing market regimes in near real-time.

- Enhances credibility and robustness of stress testing frameworks.

2. Surrogate Modeling for Scenario Pricing

Objective:

Accelerate the pricing of complex portfolios under thousands of scenarios without compromising accuracy.

Methodology:

- Train surrogate models (e.g., neural networks, gradient-boosted trees) on outputs from existing pricing engines.

- Use active learning to identify and retrain on high-error regions of the pricing space.

- Deploy surrogate models as a pre-screening or acceleration layer within the Monte Carlo simulation pipeline.

Implementation:

- Integrate surrogate models into the risk engine to approximate pricing for standard instruments.

- Use full pricing models selectively for edge cases or validation.

- Monitor surrogate model drift and retrain periodically.

Benefits:

- Enables near real-time margin recalibration.

- Reduces computational load and latency.

- Supports intraday risk monitoring and what-if analysis.

3. Model Calibration and Optimization

Objective:

Continuously refine model parameters to reflect evolving market dynamics and portfolio compositions.

Methodology:

- Use reinforcement learning or Bayesian optimization to calibrate model parameters (e.g., volatility scaling, correlation matrices).

- Analyze real-time and historical data to detect shifts in risk factor behavior.

- Implement feedback loops from backtesting and margin breaches to improve calibration accuracy.

Implementation:

- Automate calibration routines with AI-assisted parameter tuning.

- Introduce adaptive thresholds for margin floors and buffers.

- Maintain audit trails for all AI-driven calibration decisions.

Benefits:

- Improves model responsiveness to market changes.

- Reduces procyclicality and over-margining.

- Enhances transparency and auditability of calibration logic.

4. Stress Testing and Reverse Stress Analysis

Objective:

Improve the realism, diversity, and predictive power of stress testing frameworks.

Methodology:

- Use AI-generated scenarios to simulate multi-asset contagion and feedback loops.

- Apply graph-based models to map interdependencies across portfolios and members.

- Conduct reverse stress testing using AI to identify conditions that could lead to margin shortfalls or systemic breaches.

Implementation:

- Integrate AI-generated stress paths into existing stress testing infrastructure.

- Use scenario clustering to identify systemic vulnerabilities.

- Align outputs with regulatory stress testing requirements.

Benefits:

- Enhances systemic risk visibility.

- Supports preemptive margin policy adjustments.

- Strengthens regulatory compliance and member confidence.

Governance and Risk Controls

To ensure safe and effective AI adoption, the following principles must be embedded:

- Explainability: All AI models must be interpretable and justifiable.

- Validation: Models must undergo rigorous backtesting and benchmarking.

- Auditability: Maintain full traceability of AI-driven decisions.

- Human Oversight: Critical margin-impacting decisions must remain under expert supervision.

Conclusion

AI offers a clear path to modernizing CCP risk models—making them more adaptive, efficient, and robust. By focusing on scenario generation, pricing acceleration, model calibration, and stress testing, CCPs can significantly enhance their ability to manage risk in a dynamic market environment—without compromising transparency or regulatory integrity.