This post is next in series, the first one covered the Impact of Climate Change, the second talks about the Scenario-Based Modeling. This post, Managing climate risk through enhanced disclosure and reporting standards is yet another essential pillar for addressing the challenges posed by climate change. Models like the TCFD and SASB provide frameworks for companies to disclose information on their climate-related risks and opportunities. It helps investors to assess the potential impacts of climate change on their portfolios.

Task Force on Climate-related Financial Disclosures (TCFD)

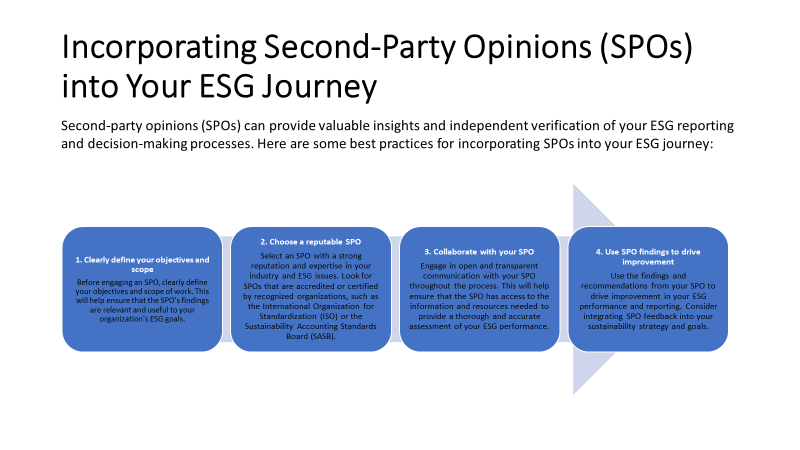

The TCFD framework provides guidance for companies to disclose information on their climate-related risks and opportunities across four areas. These four are: governance, strategy, risk management, and metrics and targets. While the first three areas provide a foundation for effective climate risk management. Metrics and targets are critical for tracking progress and demonstrating transparency.

The TCFD framework suggests that companies disclose metrics and targets related to both physical and transition risks and opportunities. Physical risks refer to the direct impacts of climate change. These risk can be extreme weather events, sea-level rise, and changes in temperature and precipitation patterns. Transition risks, on the other hand, arise from the transition to a low-carbon economy. Transition risks include changes in policy, technology, and consumer preferences.

TCFD KPIs

The reporting on under the TCFD framework can vary depending on the industry, size, and nature of their operations. Some of the key performance indicators (KPIs) that companies generally report on under the TCFD framework include:

- Greenhouse gas emissions: This is a widely used metric for measuring a company’s carbon footprint. Companies report on their emissions of carbon dioxide, methane, and other greenhouse gases, both in absolute terms and as intensity metrics (such as emissions per unit of revenue or production). It covers direct emissions from owned or controlled sources, indirect emissions from the generation of purchased energy, and emissions from activities in the value chain, respectively.

- Energy consumption: Companies disclose their energy consumption and the sources of energy they use, such as renewable or non-renewable sources. This information can help investors understand a company’s exposure to energy price volatility and its progress towards reducing its reliance on fossil fuels. This metric can be reported in terms of total energy consumption, energy consumption per unit of output, or energy intensity.

- Water usage: Companies report on their water usage and the sources of water they use, such as freshwater or recycled water. This information is particularly relevant for industries that are water-intensive, such as agriculture, mining, and energy. This metric can be reported in terms of total water usage, water usage per unit of output, or water intensity.

- Climate-related risks and opportunities: Companies disclose information on the financial impacts of climate-related risks and opportunities on their business, such as changes in revenue, costs, and asset valuations.

- Scenario analysis: Companies conduct scenario analysis to assess the potential impacts of different climate scenarios on their business. This can help companies identify potential risks and opportunities and inform their strategic decision-making.

A model implementation of TCFD

One of the banks that has integrated TCFD reporting into its annual financial results is HSBC Holdings plc. In its 2020 Annual Report, HSBC disclosed its climate-related risks and opportunities in accordance with the TCFD framework.

HSBC’s TCFD reporting is part of the bank’s broader commitment to sustainability and responsible finance. HSBC has set a goal to provide between $750 billion and $1 trillion in financing and investment for sustainable activities by 2030 and has pledged to align its portfolio of financed emissions with the Paris Agreement goal of limiting global warming to well below 2 degrees Celsius.

Conclusion

By integrating TCFD reporting into its annual financial results increasingly, Financial institutions are demonstrating its commitment to transparency and accountability in managing its climate-related risks and opportunities. The reporting provides investors with the information they need to make informed decisions about the bank’s long-term sustainability performance. The widespread adoption of these reporting standards is crucial for enabling the financial system to manage climate risk effectively and contribute to a more sustainable future.