In my two decades of experience in designing and delivering solutions for financial institutions, I’ve often been asked about the best cross-assets front-to-back treasury solution like Murex and Calypso. Let’s dive in.

I’ve worked with top trading and risk management systems, like Murex and Calypso. They have their unique strengths that suit different financial needs. Both systems offer efficient implementation and great after-sales service.

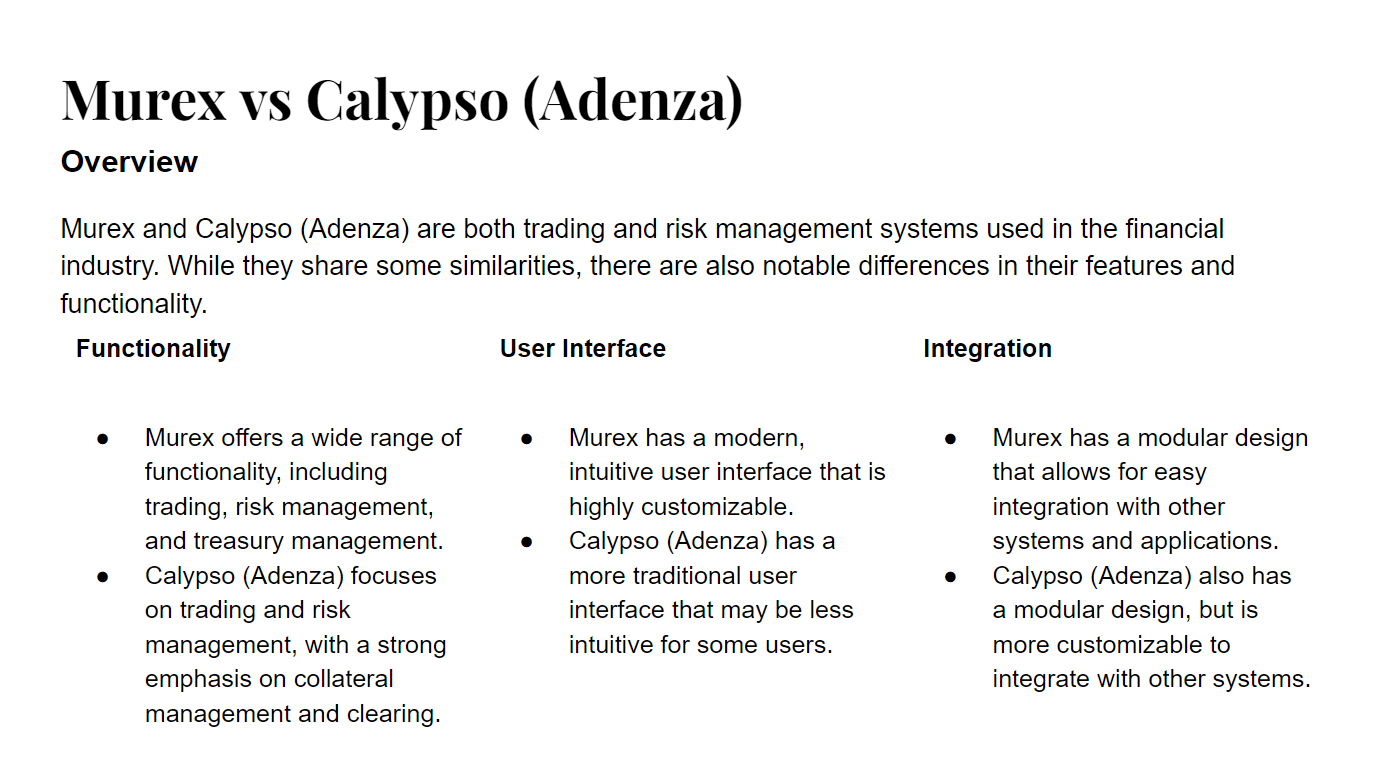

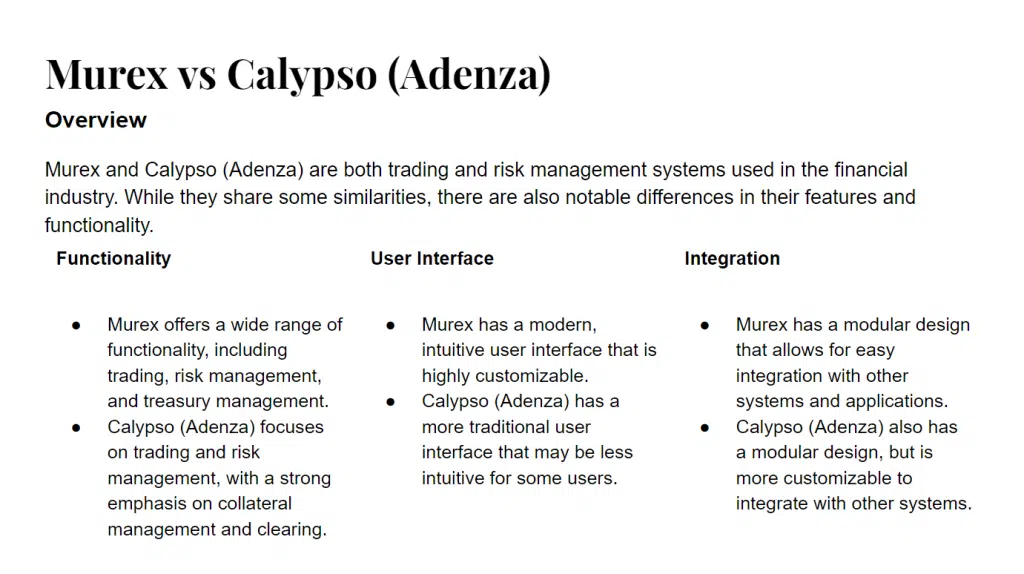

Murex:

- Easy-to-Use Interface: Murex is known for its user-friendly interface. It’s easy to navigate and customize, enhancing user experience.

- Seamless Integration: Murex connects well with other systems and trading platforms, ensuring smooth data flow across functions.

- Advanced Risk Management: Murex provides tools to manage market, credit, and operational risks effectively. It’s adaptable to various trading activities.

Calypso (Adenza):

- Expertise in Complex Derivatives: Calypso (Adenza) excels in handling intricate financial instruments like complex derivatives and structured products.

- Customizable: Calypso (Adenza) is highly configurable, letting users personalize dashboards and processes to their needs.

- Noteworthy Clearing Module: Calypso (Adenza) has a top-class clearing module used by leading OTC clearing houses worldwide.

These systems, Murex and Calypso, have strengths that match different financial requirements, making them valuable choices in the industry.