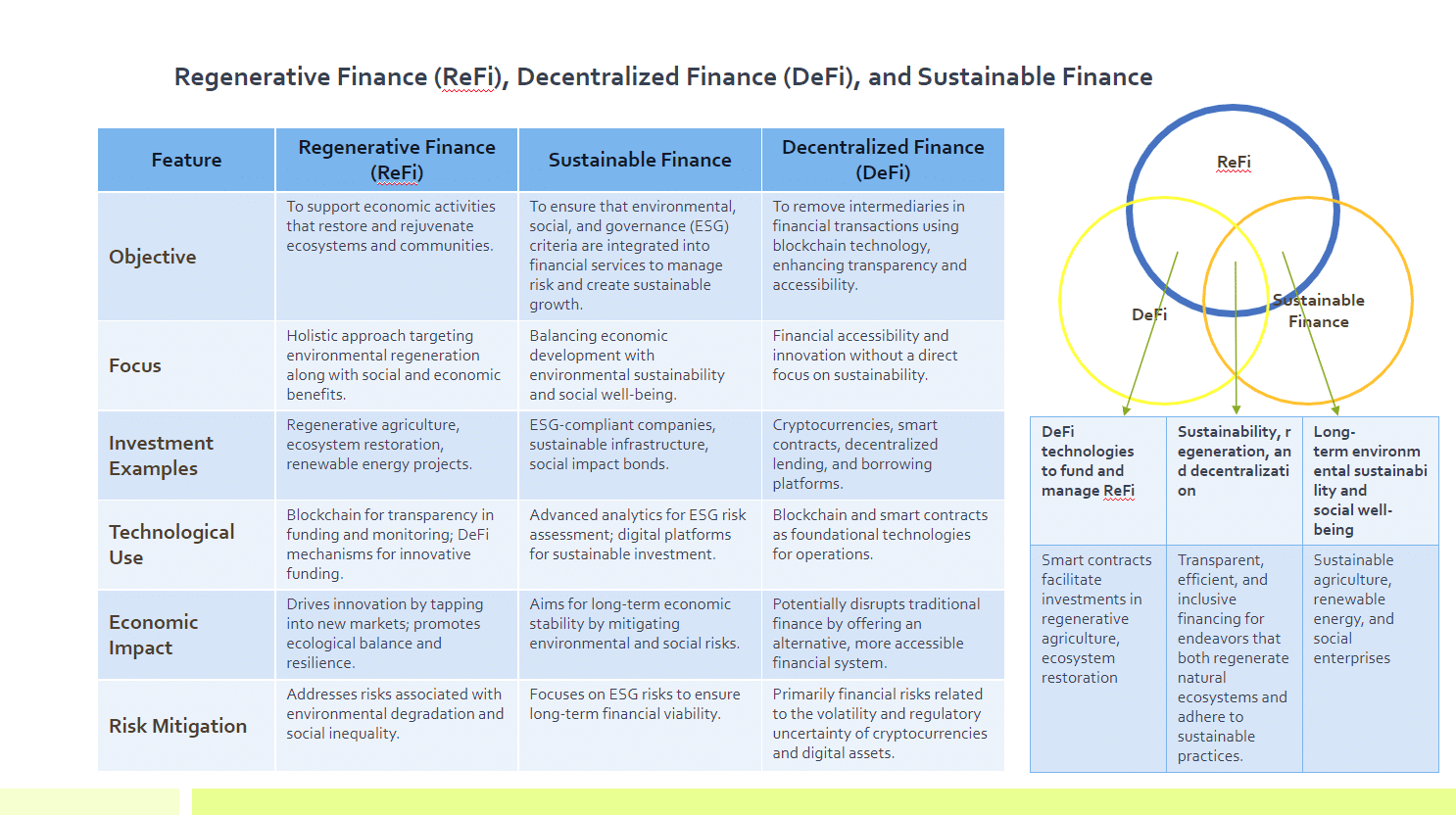

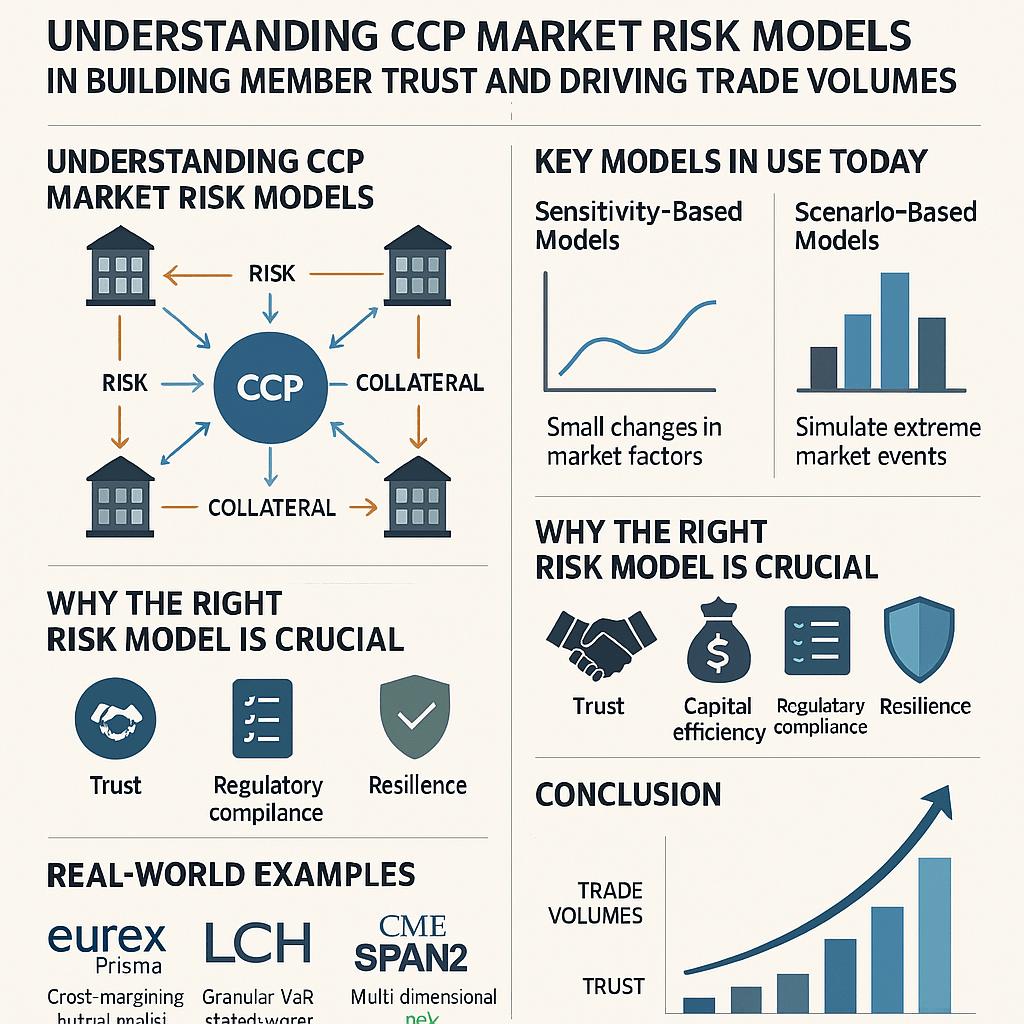

In the complex world of financial markets, Central Counterparties (CCPs) play a pivotal role in ensuring the safety and efficiency of trading ecosystems. At the heart of their operations lie market risk models—sophisticated frameworks that determine how much collateral clearing members must post to cover potential losses. These models are not just technical tools; they are foundational to building trust, ensuring systemic stability, and driving trade volumes.I’ve requested a larger, high-resolution version of the infographic for you. It will appear below shortly. Let me know if you’d like it formatted for a specific use—like a slide deck, poster, or social media post.

Understanding CCP Market Risk Models

CCP market risk models are designed to quantify potential losses in the event of market volatility or member default. Their primary function is to calculate Initial Margin (IM)—the collateral required to cover potential future exposure over a specified risk horizon.

These models must strike a delicate balance:

- Too conservative, and they tie up excessive capital, discouraging participation.

- Too lenient, and they expose the CCP and the broader market to systemic risk.

Thus, the credibility and transparency of these models are essential for member confidence and regulatory compliance.

Key Models in Use Today: Sensitivity-Based and Scenario-Based

Modern CCPs typically employ one or both of the following approaches:

1. Sensitivity-Based Models

These models assess how a portfolio responds to small changes in market risk factors (e.g., interest rates, credit spreads, FX rates). They are often used in conjunction with Value-at-Risk (VaR) or Expected Shortfall (ES) methodologies.

- Pros: Granular, risk-sensitive, and adaptable to portfolio diversification.

- Cons: May underestimate risk in extreme market conditions.

2. Scenario-Based Models

These simulate the impact of historical or hypothetical market events on a portfolio. They are particularly useful for capturing tail risks and non-linear exposures.

- Pros: Better at capturing extreme events and stress scenarios.

- Cons: Can be computationally intensive and less responsive to real-time market changes.

Many CCPs blend both approaches to create hybrid models that offer robustness and responsiveness.

Why the Right Risk Model is Crucial for CCP Success

A well-designed risk model is a strategic asset for any CCP. Here’s why:

- Trust and Transparency: Members are more likely to engage with CCPs that offer clear, consistent, and explainable margin methodologies.

- Capital Efficiency: Optimized models reduce unnecessary collateral requirements, freeing up capital for trading and investment.

- Regulatory Alignment: Compliance with global standards (e.g., CPMI-IOSCO, EMIR, CFTC) is non-negotiable.

- Resilience in Crises: Robust models help CCPs withstand market shocks, preserving market integrity.

Real-World Examples

Several leading CCPs and industry initiatives exemplify the evolution and impact of advanced risk models:

🔹 Eurex Prisma

- A portfolio-based margining system that uses a combination of sensitivity and scenario-based approaches.

- Offers cross-margining across asset classes, enhancing capital efficiency.

- Widely praised for its transparency and responsiveness.

🔹 LCH (London Clearing House)

- Uses VaR-based models tailored to each asset class.

- Known for its granular risk factor modeling and robust backtesting.

- Plays a central role in clearing interest rate swaps globally.

🔹 CME SPAN 2

- The next generation of the original Standard Portfolio Analysis of Risk (SPAN) model.

- Incorporates multi-dimensional risk factors and non-linear risk aggregation.

- Designed to improve margin accuracy and reduce procyclicality.

🔹 ISDA SIMM (Standard Initial Margin Model)

- An industry-wide model for non-cleared derivatives.

- Based on a sensitivity-based approach, promoting consistency across counterparties.

- While not a CCP model per se, it influences CCP practices and fosters alignment.

Conclusion: Risk Models as Catalysts for Growth

In today’s interconnected markets, CCPs are more than just risk mitigators—they are enablers of trust and liquidity. The sophistication and transparency of their market risk models directly influence:

- Member participation

- Trade volumes

- Market stability

As financial markets evolve, so too must these models—embracing AI, real-time analytics, and cross-asset integration. The future belongs to CCPs that can combine robust risk management with capital efficiency, driving both safety and growth.