Quantum computing is an emerging field that holds the potential to revolutionize the way we solve complex problems in a variety of domains, including finance and investment banking. While classical computers use bits to represent data as 0s and 1s, quantum computers use quantum bits, or qubits, which can exist in a superposition of both states simultaneously. This allows quantum computers to perform certain types of calculations much faster than classical computers, making them well-suited for tackling complex optimization problems in areas such as portfolio optimization in investment banking.

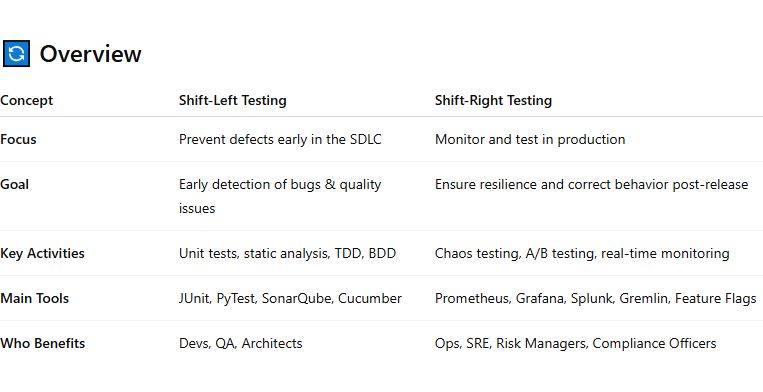

Key Differences Between Classical and Quantum Computing

The key difference between classical and quantum computing is that while classical computers process data in a sequential manner, quantum computers can process data in parallel, allowing them to perform certain calculations much faster than classical computers. Quantum computers also use quantum mechanics, which allows qubits to exist in a superposition of states and can be entangled, allowing them to perform complex calculations on large datasets more efficiently than classical computers.

Quantum Computing Use Case for Investment Banking

One potential use case for quantum computing in investment banking is portfolio optimization. Portfolio optimization is the process of selecting a portfolio of assets that maximizes returns while minimizing risk. Classical computers can take a long time to perform these calculations, especially when dealing with large datasets. Quantum computers, on the other hand, can perform these calculations much faster, enabling investment banks to optimize their portfolios in real-time.

Quantum Machine Learning Algorithm for Portfolio Optimization

One quantum machine learning algorithm that can be applied to achieve a solution for portfolio optimization is the Quantum Variational Eigensolver (QVE) algorithm. QVE is a hybrid quantum-classical algorithm that can be used to find the ground state energy of a Hamiltonian. This can be used for portfolio optimization by representing the portfolio as a Hamiltonian and searching for the ground state that minimizes risk while maximizing returns. By using QVE, investment banks can optimize their portfolios much faster than classical computing methods.

Solution for Portfolio Optimization using QVE

To use QVE for portfolio optimization, the investment bank would first need to represent the portfolio as a Hamiltonian. This can be done by assigning each investment a binary variable that represents whether or not it is included in the portfolio. The Hamiltonian can then be defined as a sum of terms that represent the returns and risks of each investment, as well as the correlations between them. The QVE algorithm can then be used to find the ground state of the Hamiltonian, which represents the optimal portfolio that maximizes returns while minimizing risk.

Key Risks and Challenges

One of the key risks of using quantum computing in investment banking is the lack of available hardware and software resources. Quantum computers are still in the early stages of development, and it can be difficult and expensive to acquire the necessary hardware and software to run quantum algorithms. Additionally, the field of quantum computing is still relatively new, and there is a shortage of professionals with the necessary skills and knowledge to develop and run quantum algorithms.

Mitigation Plan

To mitigate the risks of using quantum computing in investment banking, investment banks can partner with quantum computing providers or develop their own quantum computing infrastructure. They can also invest in training programs for their employees to develop the necessary skills and knowledge to work with quantum algorithms. Additionally, investment banks can start small by focusing on smaller problems before scaling up to larger, more complex problems.

Conclusion

In conclusion, quantum computing can offer investment banks the opportunity to optimize their portfolios faster and more efficiently than classical computing methods. By implementing quantum machine learning algorithms like QVE, investment banks can unlock new opportunities for growth and profitability. While there are risks and challenges associated with quantum computing in investment banking, investing in necessary resources, and skill development can lead to significant benefits. It is an exciting time for investment banking as quantum computing continues to develop, and the potential for innovation and transformation is immense.