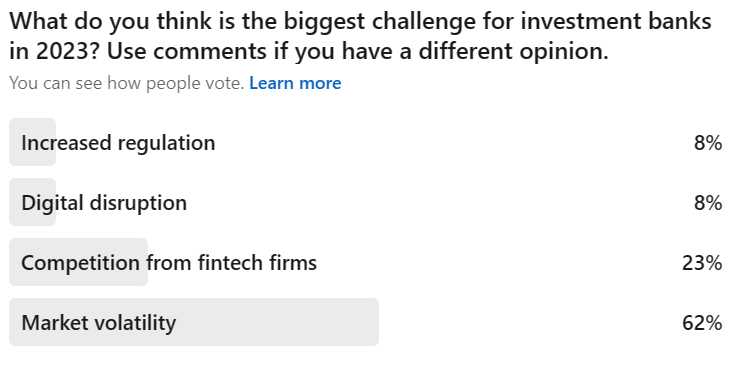

Market volatility has become a major challenge for investment banks in recent years, posing a growing concern for the financial industry. The unpredictability and complexity of the market, coupled with the increasing regulatory requirements, have made it difficult for banks to manage their risk exposures and generate profits. In this blog post we will talk about Market Vol, its challenges and how to tame it. This post is an result of the poll conducted via my LinkedIn profile.

Market volatility and its challenges for investment banks

Market volatility refers to the fluctuation in prices of financial assets such as stocks, bonds, and commodities. The unpredictability of the market can create significant challenges for investment banks, as it affects their risk management practices, financial performance, and regulatory compliance. Banks are exposed to market risks through their trading activities, investments, and hedging strategies. Market volatility can lead to losses, write-downs, and reduced profitability, as well as affect the bank’s liquidity and capital position. The challenge is to balance the risk and reward in the face of market uncertainty.

Why is market volatility a growing concern?

Market volatility is a growing concern for investment banks due to various factors. Firstly, the increasing interconnectedness and complexity of financial markets make it harder to predict market movements and manage risks. Secondly, the regulatory environment has become more stringent, requiring banks to hold higher levels of capital and liquidity to absorb potential losses. Thirdly, the rise of technology and automation has increased the speed and scale of trading activities, making it more challenging to monitor and control risk exposures.

What can be done?

To manage market volatility, investment banks need to adopt a comprehensive risk management approach that includes quantitative models, scenario analysis, stress testing, and active monitoring. Banks must also develop a robust compliance framework to meet regulatory requirements and enhance transparency. Investment banks can use various tools and technologies, such as artificial intelligence and machine learning, to improve their risk management practices and generate insights. Additionally, banks can diversify their portfolio, reduce their leverage, and focus on long-term investment strategies.

What can be the strategy?

There is no one-size-fits-all solution to address challenges arising due to market volatility in investment banking. However, the four corner stones of an successful strategy may include:

- Diversification: Diversifying investments across different asset classes and regions can help mitigate the impact of market volatility on the portfolio.

- Active risk management: Regularly reviewing and adjusting investment strategies in response to market conditions can help mitigate the impact of market volatility on the portfolio.

- Hedging: Using hedging strategies such as derivatives to protect against downside risk can help mitigate the impact of market volatility on the portfolio.

- Using technology: Leveraging technology such as artificial intelligence and machine learning can help investment bankers identify patterns in market data and make more informed investment decisions.

Conclusion

In conclusion, market volatility is a growing concern for investment banks, as it poses significant challenges to their risk management practices, financial performance, and regulatory compliance. To manage market volatility, banks need to adopt a comprehensive risk management approach and leverage new technologies and tools.