The banking industry is in the midst of a digital revolution. Customers today expect seamless, personalized experiences across all channels, while fintech disruptors continually raise the bar. To thrive in this rapidly evolving landscape, banks must undergo a significant digital transformation—one that extends far beyond superficial UI/UX enhancements and gets to the heart of their IT infrastructure.

However, many banks still struggle with legacy systems that, while functional, have become major roadblocks to innovation and agility. A 2023 McKinsey report found that 70% of digital transformation initiatives in banking fail due to legacy system constraints and poor strategy alignment.

📜 The Legacy Problem: A Hindrance to Innovation

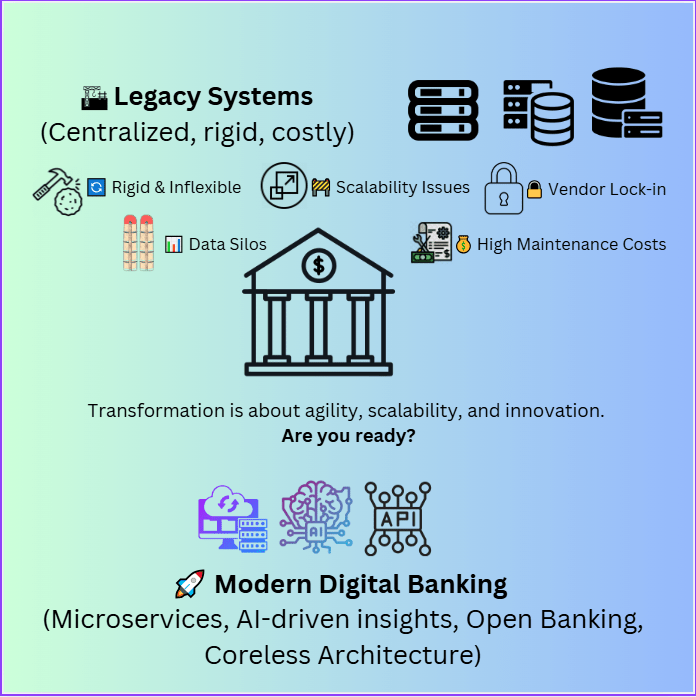

For decades, banks have relied on centralized, monolithic architectures to power their operations. While these systems provided a stable foundation, they were not built for the agility and scalability required in today’s digital-first world. Think of them as the foundation of a house that is sturdy but difficult to expand or remodel as needs evolve.

🔴 Key Limitations of Legacy Systems:

❌ Lack of Flexibility: Making even minor changes or integrating new services requires significant time, resources, and specialized expertise. ❌ Scalability Issues: Handling increased transaction volumes often demands expensive hardware upgrades. ❌ Data Silos: Information is trapped in disconnected systems, making real-time insights and data-driven decision-making challenging. ❌ Vendor Lock-in: Dependence on a single vendor limits flexibility and slows innovation. ❌ High Costs & Delays: Large-scale implementations often exceed budgets and timelines due to complexity.

📊 A recent Capgemini study revealed that banks relying on legacy systems spend up to 75% of their IT budgets on maintenance, leaving little room for innovation.

🔥 Beyond Cosmetics: A Deeper Transformation

Many banks mistakenly equate digital transformation with a website or mobile app refresh. While modern UI/UX is crucial for customer engagement, true transformation requires a fundamental rethinking of IT architecture. It’s not just about making things look better—it’s about adapting to a digital-first, API-driven banking ecosystem that fosters innovation and customer-centricity.

🚀 Key Areas of Transformation: ✅ Re-architecting Core Systems: Moving from monolithic to modular, microservices-based platforms. ✅ Embracing Open Banking: Enabling third-party developers to build innovative financial solutions. ✅ Leveraging Data & AI: Using predictive analytics for fraud detection, credit scoring, and hyper-personalization. ✅ Cloud Migration: Transitioning to cloud infrastructure for scalability and resilience. ✅ Process Automation: Implementing AI-driven automation to streamline operations and reduce costs.

⚠️ The Monolithic Trap: Even Modern Systems Can Fall Short

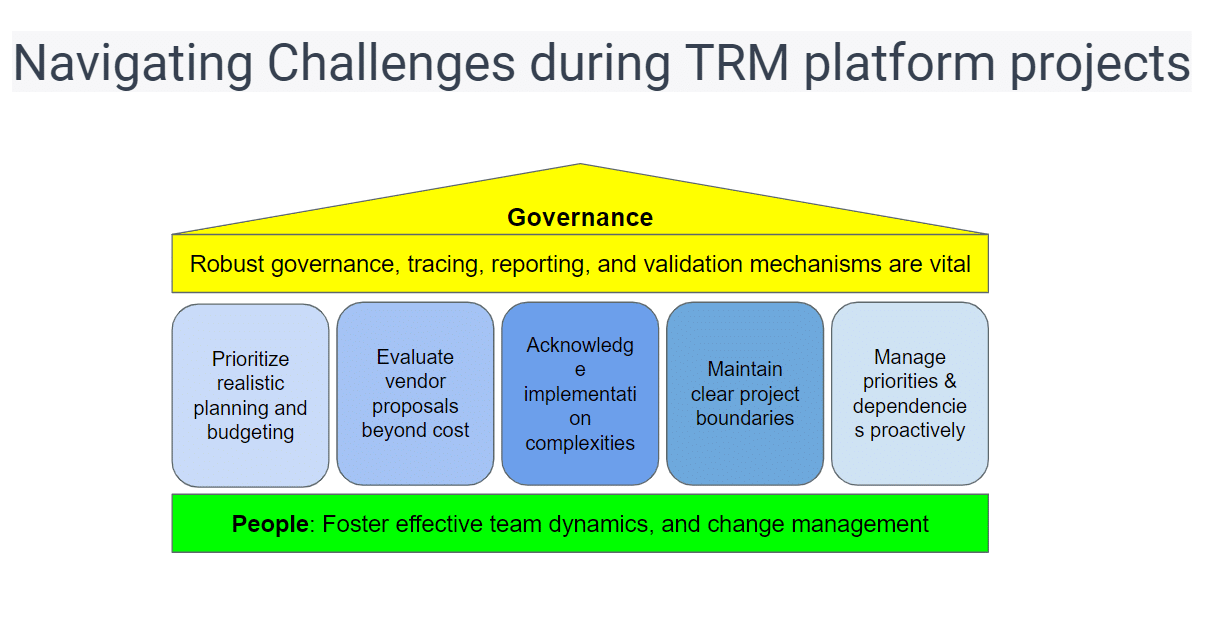

Interestingly, even seemingly modern platforms like SAP (ERP), Finacle (Core Banking), Temenos (Banking Software), Murex (Trading), and Calypso (Risk Management) can perpetuate a monolithic mindset if not implemented strategically. While these solutions offer advanced functionalities, they can still be complex, rigid, and difficult to integrate if the focus remains solely on core functionality rather than agility and composability.

🔴 Common Pitfalls: 🚫 Prioritizing functionality over flexibility and adaptability. 🚫 Underestimating integration complexities, leading to operational inefficiencies. 🚫 Failing to adopt a modular, API-first architecture that enables seamless third-party collaboration.

📊 According to Gartner, banks that fail to modernize beyond monolithic systems risk losing up to 30% of their market share to agile, digital-native competitors by 2030.

🌟 The Need for a New Approach

The limitations of legacy systems are evident. Banks need to move beyond maintenance-focused IT strategies and embrace a new, forward-thinking approach that prioritizes agility, scalability, and customer-centricity.

In our next post, we’ll explore the modern architectures and strategies that banks can leverage to overcome these challenges and achieve true digital transformation. We’ll delve into concepts like coreless banking, open banking, microservices, and cloud-native architectures, and discuss how these technologies can help banks unlock new levels of innovation and customer engagement. Stay tuned! 🚀

One thought on “The Challenge of Legacy and the Need for Transformation (1/2)”