The European Union (EU) has developed a comprehensive Sustainable Finance Framework to direct capital flows toward sustainable activities and achieve its ambitious climate and sustainability goals, including those outlined in the European Green Deal. This framework is built on three key pillars:

- Corporate Sustainability Reporting Directive (CSRD)

- EU Taxonomy

- Sustainable Finance Disclosure Regulation (SFDR)

Each of these pillars plays a unique role in fostering transparency, accountability, and alignment with sustainability objectives. Below is an in-depth guide to help practitioners navigate this framework effectively.

1. Corporate Sustainability Reporting Directive (CSRD)

Objective:

The CSRD aims to enhance the quality, consistency, and comparability of sustainability information disclosed by companies, enabling investors and stakeholders to make informed decisions.

Key Features:

- Applicability: Extends to large companies, listed SMEs, and non-EU companies with significant operations in the EU.

- Reporting Standards: Mandates the use of European Sustainability Reporting Standards (ESRS), developed by the European Financial Reporting Advisory Group (EFRAG).

- Double Materiality: Requires companies to report on both how sustainability issues impact their business and their impact on society and the environment.

- Auditing: Requires third-party assurance of sustainability reports.

Key Metrics:

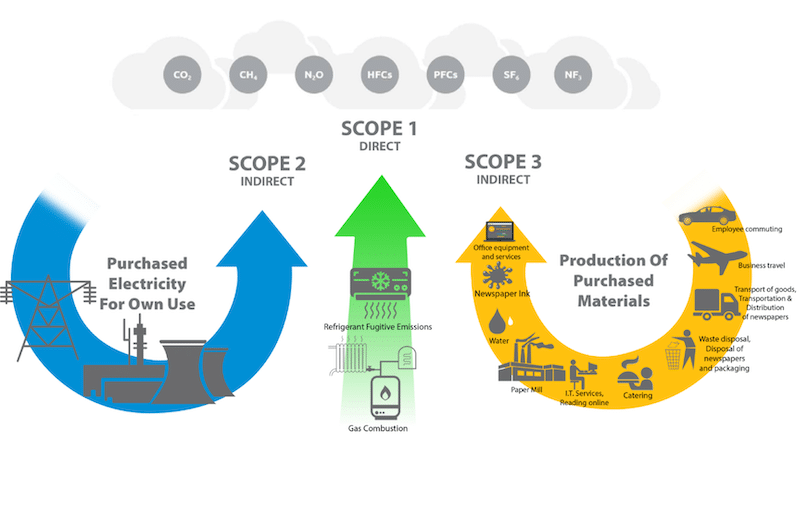

- Environmental: Greenhouse gas (GHG) emissions (Scope 1, 2, and 3), energy consumption, waste management, biodiversity impact.

- Social: Employee diversity, health and safety, human rights compliance, supply chain impacts.

- Governance: Board diversity, anti-corruption measures, executive compensation tied to ESG targets.

Coverage:

- Large public and private companies with over 250 employees, €40M turnover, or €20M in total assets.

- SMEs listed on regulated markets (simplified requirements).

Practical Tips for Practitioners:

- Integrate Systems: Align financial and non-financial reporting systems to streamline compliance.

- Collaborate: Work with external consultants or ESG experts to align with ESRS.

- Engage Auditors: Prepare for assurance requirements early by engaging with auditors.

2. EU Taxonomy

Objective:

The EU Taxonomy is a classification system designed to define environmentally sustainable economic activities.

Key Features:

- Six Environmental Objectives:

- Climate change mitigation

- Climate change adaptation

- Sustainable use and protection of water and marine resources

- Transition to a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity and ecosystems

- Do No Significant Harm (DNSH) Principle: Activities must not harm other environmental objectives.

- Minimum Safeguards: Compliance with social standards, such as OECD Guidelines and UN Guiding Principles on Business and Human Rights.

Key Metrics:

- Revenue Alignment: Percentage of revenue derived from taxonomy-aligned activities.

- CapEx and OpEx: Proportion of investments and operational expenditure aligned with the taxonomy.

Coverage:

- Applies to financial institutions, companies under CSRD, and policymakers.

- Focuses on activities within industries with a significant environmental impact (e.g., energy, transport, construction).

Practical Tips for Practitioners:

- Data Collection: Work with counterparties to gather taxonomy-aligned data.

- Training: Educate teams on the criteria for taxonomy alignment.

- Prioritize Key Activities: Focus initially on high-impact areas.

3. Sustainable Finance Disclosure Regulation (SFDR)

Objective:

The SFDR seeks to increase transparency about the sustainability characteristics and impacts of financial products to prevent greenwashing.

Key Features:

- Product Categorization: Financial products are classified as:

- Article 6: Products without explicit ESG objectives.

- Article 8: Products promoting environmental or social characteristics.

- Article 9: Products with sustainable investment as their objective.

- Principal Adverse Impacts (PAI): Financial market participants must disclose how their investments impact various ESG factors.

Key Metrics:

- Environmental: GHG emissions, carbon footprint, energy efficiency.

- Social: Violations of UN Global Compact principles, gender diversity.

- Governance: Board structure, anti-corruption measures.

Coverage:

- Financial market participants, including asset managers, insurers, and pension funds.

- Applies to all financial products marketed in the EU.

Practical Tips for Practitioners:

- Implement PAI Tracking: Develop systems to track and report adverse impacts.

- Classify Products: Review fund objectives and reclassify them under Article 6, 8, or 9 as needed.

- Engage Stakeholders: Communicate clearly with investors about ESG objectives and methodologies.

Interrelation Between the Pillars

- CSRD and SFDR: CSRD provides the corporate-level ESG data required for financial institutions to fulfill SFDR reporting requirements.

- CSRD and EU Taxonomy: CSRD requires companies to disclose taxonomy alignment metrics, such as revenue, CapEx, and OpEx.

- SFDR and EU Taxonomy: Financial products categorized under SFDR Article 8 and 9 must disclose alignment with the EU Taxonomy.

Key ESG Metrics for the Financial Industry

| Category | Metric | Framework |

|---|---|---|

| Environmental | GHG Emissions (Scope 1, 2, 3) | CSRD, SFDR |

| Percentage taxonomy-aligned revenue | EU Taxonomy | |

| Carbon footprint of investments | SFDR | |

| Social | Gender pay gap | CSRD, SFDR |

| Supply chain human rights compliance | CSRD | |

| Governance | Board diversity | CSRD |

| Anti-corruption policies | CSRD, SFDR |

Checklist for Practitioners

- Data Readiness: Ensure systems can capture and report required ESG data.

- Stakeholder Engagement: Communicate ESG efforts transparently with investors, clients, and regulators.

- Training and Expertise: Build internal capacity for understanding and implementing ESG requirements.

- Technology Investments: Leverage AI and analytics tools for taxonomy alignment and PAI tracking.

- Early Adoption: Pilot ESG initiatives and reporting frameworks ahead of mandatory deadlines.

By understanding the pillars of the EU Sustainable Finance Framework and aligning organizational practices with these regulations, financial institutions can ensure compliance while unlocking opportunities in sustainable finance. This cheat sheet serves as a roadmap for navigating the complexities of CSRD, EU Taxonomy, and SFDR to achieve both regulatory and strategic ESG goals.